Republicans are proposing a huge, huge cut in corporate tax rates. They are also proposing to let giant, multinational corporations keep much of the taxes they already owe on profits they are keeping in “offshore” tax havens.

Lower tax rates mean higher after-tax profits, which increases the value of stock holdings.

Who owns corporate stock, and therefore receives the benefits of these tax cuts?

Do We All Benefit From Corporate Stock?

Lets look at just who owns corporate stock.

Republicans like to pretend that all of us are invested in the stock market, if not by directly owning stocks, then through “our” retirement plans. This is usually written by and believed by upper-level, comfortable people that actually do have retirement plans.

But 45% of Americans have no money for retirement at all. Only 44% of Americans put anything into a 401K if their company offers one — and this number includes workers with only $100 in the plan. Only 18% of Americans are putting money in an Individual Retirement Account (IRA), which may or may not hold stocks. Only 4% of private-sector workers have only a “defined benefit” plan, usually called a pension.

So much for “our” retirement plans. Aside from retirement plans, a 2016 Gallup survey found that only 52% of Americans own any stocks at all – down from 65% in 2007.

So Who Does Own Stock?

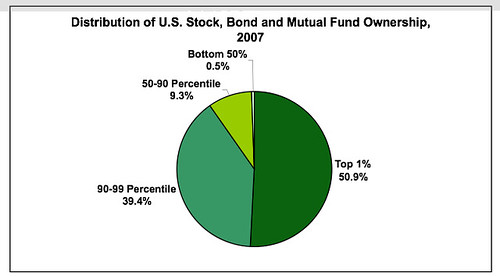

Here is a chart of who owns corporate stock (and therefore pays those taxes.)

As of 2007, the top 1 percent owned 50.9 percent of all stocks, bonds, and mutual fund assets. The top 10 percent owned 90.3 percent. Things have only concentrated upward since 2007.

How much have things concentrated upwards since then? Twenty Americans now hold as much wealth as half of all Americans put together and “the 400 richest Americans now have more wealth than the bottom 61 percent of the population.”

People talk about an “upper class” that holds most of the wealth in our society now. Maybe the thinking on this needs to change from a “class” of people to just a few people.

It is these few people who are the beneficiaries of corporate tax cuts. As tax rates drop the value of their stock holdings rises. The rest of us lose our ability to have good schools, roads, health care, courts, scientific research and all the rest of the things our government tries to do to make our lives better.

This is who we are talking about when we talk about corporate tax rates. It’s not anonymous, nameless corporation, it is people — just a few people.

Editor’s Note: This essay originally appeared at Campaign for America’s Future (CAF) at their Blog for OurFuture. It also appeared on April 28, 2017 on Seeing the Forest, a website featuring commentary by Dave Johnson, frequent public speaker and talk-radio guest and a leading participant in the progressive blogging community. It was reproduced here with the consent of Mr. Johnson.

Leave a Reply